UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under § 240.14a-12

DUTCH BROS INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required.

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

Everyone who works for Dutch Bros is familiara business built on relationships—relationships with our communities, our franchisees and operators, our broistas, and our customers. This year, we’re doubling down on building these relationships as we execute on our growth objectives.

Growth and the Optimist Creed. It sets the tone for the culture we’re known for—positive, inclusive, enthusiastic and resilient. It starts with a call to action to be so strong that nothing can disturb your peace of mind. As we close out 2022 and look toDutch Bros People Pipeline

In 2023, we look to those words to guide us.

For nearly everyone—whether companies in the beverage industry or families at home—2022 was a year of unexpected challenges. Inflation weighed on the economy and discussions of what’s next dominated the news. Despite the headwinds, Dutch Bros made good on its mission to make a massive difference, one cup at a time, and continued its highas we leaned into our growth story. In total, weopportunities. We opened 133a record 159 new shops in 2022,2023, created opportunities for 3431 new operators, and donated more than $6.2$6.8 million to local and national causes through company-wide and local giveback days.

Growth and the Dutch Bros People Pipeline

People are at the heart of everything we do. Our growth is predicated onProviding opportunities for our people pipeline—to continue to grow motivates us. With each new shop opening, we create opportunities for dedicated broistas who have worked their way up in the organization and proven themselves as great leaders and culture cultivators. In 2022,2023, our people pipeline grew from 200275 fully-qualified regional operator candidates to more than 275. These are people who have taken part in the Leadership Pathway program and are eligibleapproximately 350. Each one of these candidates is now ready to join a new community, and open multiple shops.

Our people pipeline and development team allowed Dutch Bros to open 26 company-operated shopsmake a difference in the fourth quarterlives of 2022, bringing our total number of shops to 671 as of December 31, 2022. Q4 was the sixth straight quarter of unit growthbroistas and a sign that we’re ready, willing,customers, and able to overcome the economic challenges we all face.

It’s important to note the focus on our people goes beyond the people pipeline. We believe Dutch Bros should be a foundation for all employees to build the life they want; we should help them find their compelling future. While Dutch Bros provides a range of benefits supporting that goal, including an extensive education grant program, we recognize the importance of financial stability. That’s why we closed out the year with the decision to raise our base wage across the company to at least $10 per hour.ultimately run between three and seven shops.

Focus on Technologythe Customer

TheOur customers are at the heart of everything we do. Across the board, from broistas to executive leadership, Dutch Bros apphas an obsession with doing the right thing for each and Dutch Rewardsevery customer. That focused intensity will continue in 2024, through innovating, continuing to enhance our rewards program, remained one of the biggest priorities of 2022. The appand connecting with customers at our shops with Quality, Speed, and Service.

We believe our core customers like new, exciting menu offerings, and in 2023, we accelerated our innovation pipeline. In January 2024, we launched in February 2021protein coffee, which we believe provides a roadmap for future category expansion and quickly became one of the most popular apps in the foodincremental sales layers. Our customers responded better than we could have imagined, and beverage sector at the time. Today, it helps us reduce line times and is a key tool in reaching customers on a one-on-one basis through targeted promotions. We’re proudwe are encouraged by this approach. In addition, we’re planning to say the app is helping us connect with 5.2 million users.

Technology is on a rapid expansion of consumerizationadd unique limited time offers to our lineup and will continue to havehighlight our secret menu offerings in a way that drives awareness, interest, and loyalty.

In 2023, we adjusted the Dutch Rewards program to allow us to reinvest in customers in a more individualized way. The result was targeted, meaningful promotions aimed at solidifying brand loyalty in the coffee and energy drink categories, and driving traffic to dayparts where we saw the most opportunity. In 2023, approximately 65 percent of transactions were attributable to our Dutch Rewards members, a tremendous accomplishment for a growing brand like ours.

This year, we’re focused on stepping up our innovative approach to interacting with customers. We’re currently testing mobile order with the goal of offering it as an impact on virtually everythingoption in a majority of our shops by the industryend of the year. We think this could be a big opportunity for us, and the consumer touches. From cybersecuritywe are committed to POS“getting it right.” Even as we develop our consumer-facing technology, we’re dedicated to consumer interface, it is impacting and enhancing everything we do. We’re focused on putting relationships at the center of technological advancements to ensure it remains where it should be—every advancement. That means enhancing, rather than overshadowing, our business model and lives.personal connections.

Looking to the Future

As we look to the year ahead, we’re committed to continuing to invest in our people and elevating the Dutch Bros may only have operated as a public companyexperience for a limited time, but we’ve been sharingboth our customers and crews.

A major investment is the expansion of our support center in Phoenix, Arizona. By January 1, 2025, we anticipate approximately 40 percent of our operations support employees will be based in Arizona. We believe bringing people together in Phoenix will give us easier access to our communities, allowing us to better serve our shops, and open up access to the talent needed to help us scale to 4,000+ shops.

For more than 32 years, Dutch Bros has shared the “Dutch Luv” for 31 years and we’ve learned a lot. While we’ll continue to share the Dutch Luv, we’re already seeing that 2023 is going to be very different. Economic pressures, high turnover, and uncertainty will likely shape the direction of companies across the country. Wein its communities. As we enter new communities, we remain committed to the formula that has helped us grow and thrive for more than three decades—focusing on our people, keeping our customers top of mind, and growing in a way that creates opportunities to change lives. We hope you’ll join us on this journey.

| | | | | | | | |

| Travis Boersma | | Joth RicciChristine Barone |

| Co-Founder & Executive Chairman | | CEOChief Executive Officer and President |

Dutch Bros Inc.|

Dutch Bros Inc.| 20232024 Proxy Statement | 2

NOTICE OF ANNUAL STOCKHOLDERS’ MEETING

| | | | | | | | | | | | | | |

| WHEN | | WHERE | | RECORD DATE |

| | | | |

May 16, 202314, 2024 at 2:00 p.m. Pacific Time | | Via webcast: www.virtualshareholdermeeting.com/BROS2023BROS2024 | | Our Board of Directors has fixed the close of business on March 21, 2023,19, 2024, as the Record Date for determination of stockholders entitled to notice of and to vote at this Annual Meeting of the stockholders or any adjournment thereof. |

ITEMS OF BUSINESS

| | | | | | | | | | | | | | | | | | | | |

| PROPOSAL | | BOARD VOTING RECOMMENDATION | | PAGE REFERENCE |

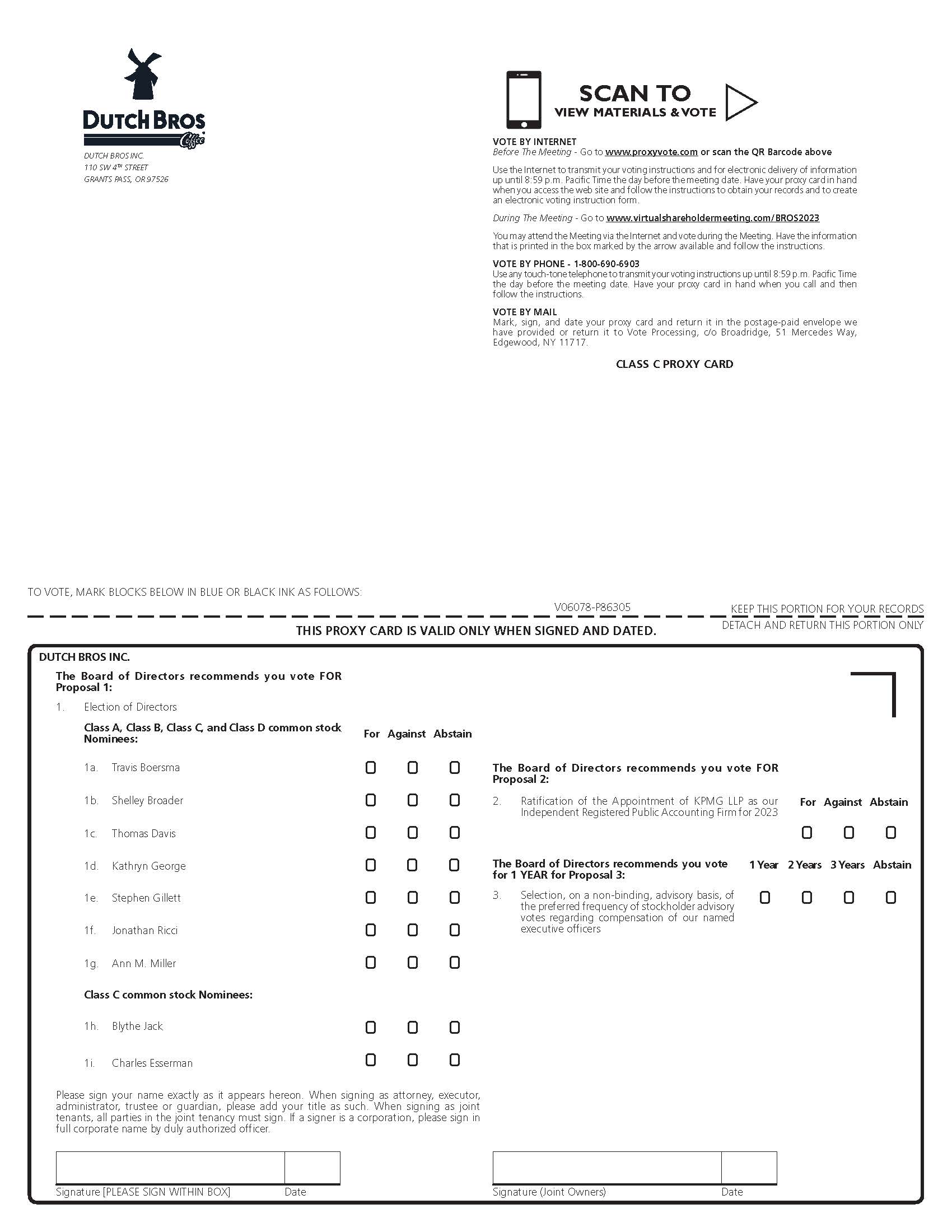

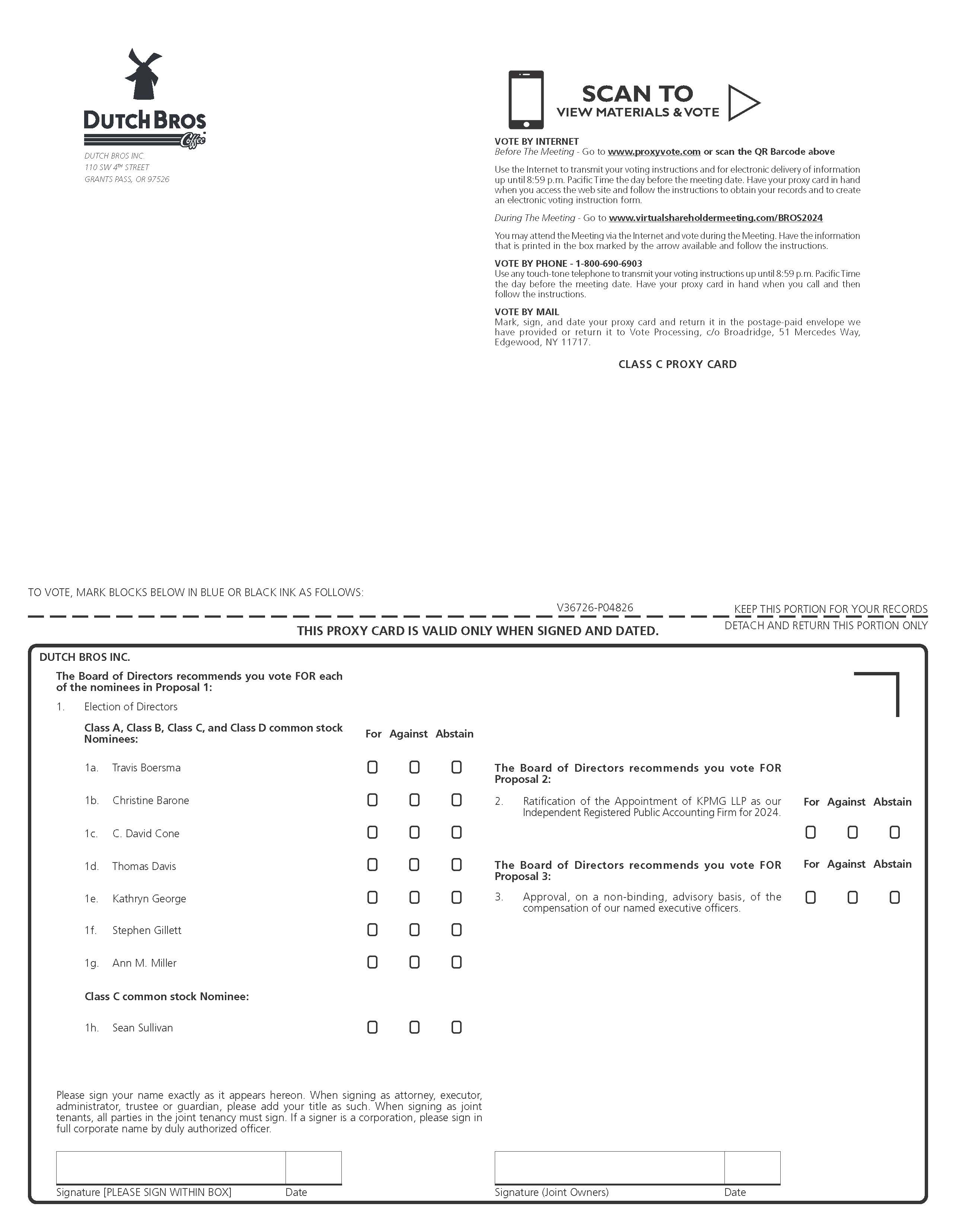

1.Elect nineeight director nominees named herein, seven of whom will be elected by the holders of our Class A common stock, Class B common stock, Class C common stock, and Class D common stock, voting together as a single class, and twoone of whom will be elected by the holders of our Class C common stock, voting as a separate class, with each director to serve until the 20242025 annual meeting of stockholders. | | ☑ | | FOR each director nominee | | |

2. Ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2023.2024. | | ☑ | | FOR | | |

3. Selection,Approval, on a non-binding, advisory basis, of the preferred frequency of stockholder advisory votes regarding compensation of our named executive officers. | | ☑ | | ONE YEARFOR | | |

| 4. Any such other business as may properly come before the meeting or any adjournment or postponement thereof. | | | | | | |

These items of business are more fully described in the proxy statement accompanying this Notice of Annual Stockholders’ Meeting.

You will be able to attend this year’s Annual Meeting virtually via live webcast at www.virtualshareholdermeeting.com/BROS2023.BROS2024. You will be able to submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/BROS2023.BROS2024. You will also be able to vote electronically during the Annual Meeting. Details regarding how to participate in the meeting online and the business to be conducted at the Annual Meeting are more fully described in the accompanying proxy statement.

Important Notice Regarding the Availability of Proxy Materials for the Annual Stockholders’ Meeting to be held on May 16, 2023,14, 2024, at 2:00 p.m. Pacific Time virtually via live webcast at www.virtualshareholdermeeting.com/BROS2023.BROS2024. This Notice of Annual Stockholders’ Meeting, the proxy statement, and the 20222023 Annual Report on Form 10-K are available at www.proxyvote.com.

A Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy materials and annual report, as well as instructions on how to vote over the internet, via phone, or by mail will be mailed to you on or about April 3, 2023.1, 2024. If you receive a Notice of Internet Availability of Proxy Materials by mail or electronic mail, you will not receive printed and mailed proxy materials unless you specifically request them.

YOUR VOTE IS VERY IMPORTANT. We hope that you will attend the Annual Meeting. Whether or not you do, please cast your vote as soon as possible.

HOW TO VOTE:

| | | | | | | | | | | | | | | | | |

| VIRTUALLY | | BY TELEPHONE | | BY MAIL | |

| Go to www.proxyvote.com | | From the United States U.S. Territories and Canada: call 1-800-690-6903 | | If you received a paper copy of the proxy materials by mail: mark, sign, date, and promptly mail the enclosed proxy card in the postage-paid envelope | |

You may vote in advance of or during the Annual Meeting. Submitting your proxy now will not prevent you from voting your shares at the Annual Meeting. You may change your vote at any time. To vote your shares online, log on to www.proxyvote.com and enter your Control Number. If you attend the Annual Meeting virtually, please follow the instructions at www.virtualshareholdermeeting.com/BROS2023BROS2024 to vote or submit questions during the meeting.

Dutch Bros Inc.|

Dutch Bros Inc.| 20232024 Proxy Statement | 3

DUTCH BROS INC.

20232024 PROXY STATEMENT AND NOTICE OF ANNUAL STOCKHOLDERS’ MEETING

TABLE OF CONTENTS

| | | | | |

| Page |

| |

| COVER PAGE | |

| LETTER TO STOCKHOLDERS | |

| |

| |

| |

| |

| NOTICE OF ANNUAL STOCKHOLDERS’ MEETING | |

| |

| |

| |

| |

| GLOSSARY | |

| |

| |

| |

| |

| QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING | |

| |

| |

| |

| |

| BOARD OF DIRECTORS MATTERS | |

| |

| |

| |

| PROPOSAL 1: ELECTION OF DIRECTORS | |

| Director Skills, Experience, and Background | |

| Board Diversity | |

| |

| CORPORATE GOVERNANCE MATTERS | |

| |

| |

| |

| Composition of our Board of Directors | |

| Board Leadership Structure | |

| Role of the Board in Risk Oversight | |

| Controlled Company Exemption | |

| Director Nominations | |

| Board Membership Criteria | |

| Stockholder Engagement and Communications with the Board of Directors | |

| Board Committees and Meetings | |

| Director Compensation | |

| Security Ownership of Certain Beneficial Owners and Management | |

| |

| AUDIT AND RISK COMMITTEE MATTERS | |

| |

| |

| |

| PROPOSAL 2: RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

| Audit and Related Fees | |

| Report of the Audit and Risk Committee | |

| |

| EXECUTIVE COMPENSATION | |

| |

| |

| |

| Compensation Discussion and Analysis | |

| Compensation Committee Report | |

| Employment Arrangements | |

| Summary Compensation Table | |

| |

| |

| Outstanding Equity Awards at Fiscal Year-End | |

| Stock Awards Vested | |

| Potential Payments upon Termination or Change of Control | |

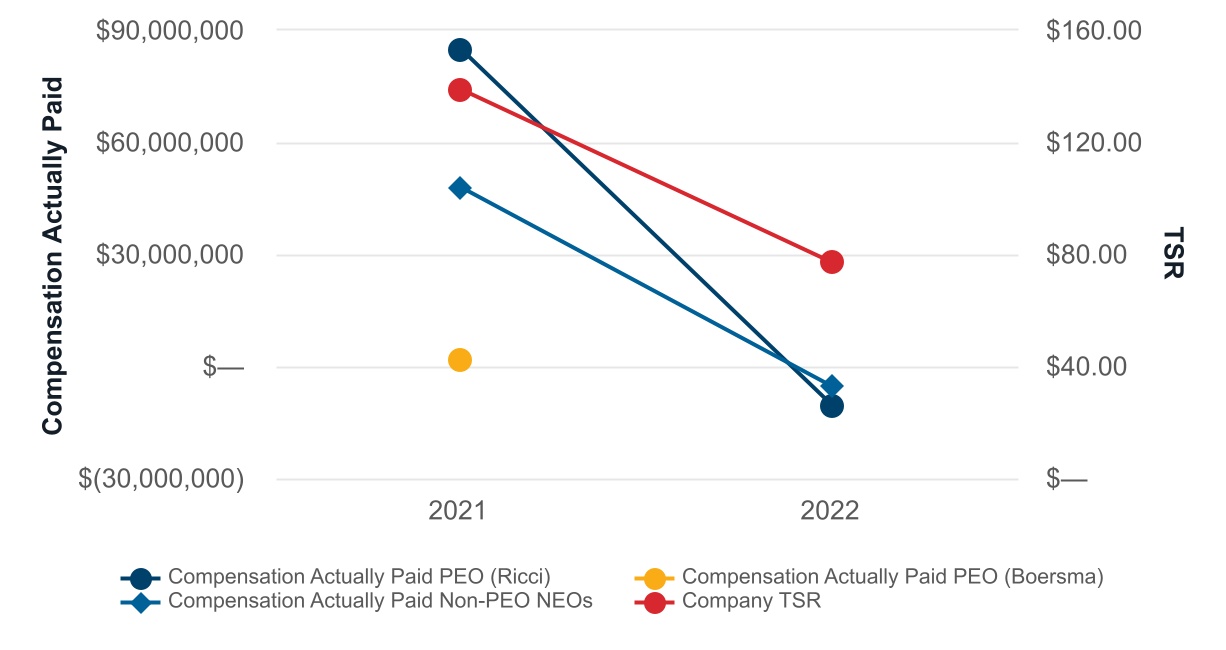

| Pay versus Performance | |

| CEO Pay Ratio | |

PROPOSAL 3: SELECTION,APPROVAL, ON ANA NON-BINDING, ADVISORY BASIS, OF THE PREFERRED FREQUENCY OF STOCKHOLDER ADVISORY VOTES REGARDING COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS | |

| |

| |

| OTHER MATTERS | |

| |

| |

| |

| Equity Compensation Plan Information | |

| Transactions with Related Persons | |

| Delinquent Section 16(a) Reports | |

| Where to Find Additional Information | |

| |

| |

| APPENDIX | |

| |

| |

| |

GLOSSARY

As used in this 20232024 proxy statement (this Proxy), the terms identified below have the meanings specified below unless otherwise noted or the context requires otherwise. References in this Proxy to “Dutch Bros,” the “Company,” “we,” “us” and “our” refer to Dutch Bros Inc. and its consolidated subsidiaries unless the context indicates otherwise.

| | | | | | | | |

| TERM | | DEFINITION |

| 2023 Annual Report | | Our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on February 23, 2024. |

| Annual Meeting | | The 20232024 Annual Stockholders’ Meeting of Dutch Bros Inc. to be held on May 16, 2023,14, 2024, at 2:00 p.m. Pacific Time. |

| | |

| Blocker Companies | | Certain Pre-IPO Dutch Bros OpCo Unitholders that are taxable as corporations for U.S. federal income tax purposes. |

| Board or Board of Directors | | The Board of Directors of Dutch Bros Inc. |

| | |

| Class A common stock | | Class A Common Stock, par value $0.00001 per share, of Dutch Bros Inc. |

| Class B common stock | | Class B Common Stock, par value $0.00001 per share, of Dutch Bros Inc. |

| Class C common stock | | Class C Common Stock, par value $0.00001 per share, of Dutch Bros Inc. |

| Class D common stock | | Class D Common Stock, par value $0.00001 per share, of Dutch Bros Inc. |

| Class A common units | | Non-voting Class A Common Units of Dutch Bros OpCo, as defined in the Third LLC Agreement. |

| Class B voting units | | Class B Voting Units of Dutch Bros OpCo, as defined in the Third LLC Agreement. |

| Class C voting units | | Class C Voting Units of Dutch Bros OpCo, as defined in the Third LLC Agreement. |

| Co-Founder | | Travis Boersma and affiliated entities over which he maintains voting control. |

| Common Units | | Common Units of Dutch Bros OpCo, as defined in theThirdthe Third LLC Agreement. |

| Continuing Members | | The Co-Founder and the Sponsor. |

| Dutch Bros OpCo | | Dutch Mafia, LLC, a Delaware limited liability company and direct subsidiary of Dutch Bros Inc. |

| Dutch Bros OpCo Units | | Class A common units, Class B voting units and Class C voting units of Dutch Bros OpCo, each as further defined in the Third LLC Agreement, collectively. |

| | |

| Dutch Bros Tax Group | | Dutch Bros Inc. or any member of its affiliated, consolidated, combined, or unitary tax group. |

| Exchange Act | | The Securities Exchange Act of 1934, as amended. |

| Exchange Tax Receivable Agreement | | The Tax Receivable Agreement (Exchanges) entered into by Dutch Bros Inc. with the Continuing Members, dated as of September 14, 2021. |

| FASB | | Financial Accounting Standards Board. |

| | |

| IPO | | Our Initial Public Offering of shares of Class A common stock. |

| Offering | | The registered underwritten public offering for the sale of 8,000,000 shares of Class A common stock by our Sponsor that closed on March 26, 2024. |

| | |

| | |

Dutch Bros Inc.| 2024 Proxy Statement | 5

Dutch Bros Inc.| 2024 Proxy Statement | 5

| | | | | | | | |

| TERM | | DEFINITION |

| Pre-IPO Blocker Holders | | TSG7 A AIV VI Holdings-A, L.P. and DG Coinvestor Blocker Aggregator, L.P. or their assignees or successors pursuant to the terms of the Reorganization Tax Receivable Agreement. |

Dutch Bros Inc.| 2023 Proxy Statement | 5

| | | | | | | | |

TERM | | DEFINITION |

| Pre-IPO Dutch Bros OpCo Unitholders | | Individuals and/or entities that held Common Units and/or Profits Interest Units immediately prior to the Reorganization Transactions. |

| Profits Interest Units and PIUs | | PI Units of Dutch Bros OpCo, issued and outstanding immediately prior to the Reorganization Transactions. |

| Record Date | | March 21, 2023.19, 2024. |

| QSR | | Quick Service Restaurant. |

| Registration Rights Agreement | | The Amended and Restated Registration Rights Agreement entered into by Dutch Bros Inc. with the Continuing Members, dated as of September 17, 2021.October 31, 2023. |

| Reorganization Tax Receivable Agreement | | Tax Receivable Agreement (Reorganization) entered into by Dutch Bros with the Pre-IPO Blocker Holders, dated as of September 14, 2021. |

| Reorganization Transactions | | The transaction to implement our “Up-C” structure undertaken in connection with our IPO, as further described in our prospectus, filed pursuant to Rule 424(b)(4), (Registration No. 333- 258988) on September 14, 2021. |

| RSA | | Restricted Stock Awards. |

| RSU | | Restricted Stock Units. |

| | |

| SEC | | United States Securities and Exchange Commission. |

| Securities Act | | The Securities Act of 1933, as amended. |

| Sponsor | | TSG Consumer Partners, L.P. and certain of its affiliates. |

| Stockholders Agreement | | Stockholders Agreement of Dutch Bros Inc., dated as of September 17, 2021. |

| Tax Receivable Agreements and TRAs | | The Exchange Tax Receivable Agreement and the Reorganization Tax Receivable Agreement. |

| Third LLC Agreement | | Third Amended and Restated Limited Liability Company Agreement of Dutch Bros OpCo, dated as of September 14, 2021. |

| | |

Dutch Bros Inc.|

Dutch Bros Inc.| 20232024 Proxy Statement | 6

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING

Although we encourage you to read this proxy statement in its entirety, we include this Q&A section to provide some background information and brief answers to several questions you might have about the Annual Meeting.

Q: Why are we providing these materials?

A: These materials are provided to you in connection with our Annual Meeting, which will take place on Tuesday, May 16, 2023,14, 2024, at 2:00 p.m. Pacific Time. Pursuant to rules adopted by the SEC, we have elected to provide access to our proxy materials over the internet. Accordingly, we have sent you a Notice of Internet Availability of Proxy Materials because our Board is soliciting your proxy to vote at the Annual Meeting, including at any adjournments or postponements of the meeting. Stockholders are invited to participate in the Annual Meeting and are requested to vote on the proposals described herein.

We intend to mail the Notice of Internet Availability of Proxy Materials on or about April 3, 2023,1, 2024, to all stockholders of record entitled to vote at the Annual Meeting.

Q: How do I attend the Annual Meeting?

A: In order to facilitate stockholder participation, the Annual Meeting will be held through a live webcast. You will not be able to attend the annual meeting in person. You, or your valid designated proxy, are entitled to attend the Annual Meeting if you were a stockholder as of the close of business on March 21, 2023,19, 2024, the Record Date. To be admitted to the Annual Meeting virtually, you will need to visit www.virtualshareholdermeeting.com/BROS2023BROS2024 and enter the 16-digit Control Number found next to the label “Control Number” on your Notice of Internet Availability of Proxy Materials, proxy card or voting instruction form (if you received a printed copy of the proxy materials), or in the email sending you the Proxy. If you are a beneficial stockholder, you should contact the bank, broker, or other institution where you hold your account in advance of the meeting if you have questions about obtaining your control number/proxy to vote.

Please note, virtual participation in the Annual Meeting is limited due to the capacity of the host platform. Access to the Annual Meeting will be accepted on a first come, first served basis, so we encourage you to log into the virtual meeting site in advance of the start time of the Annual Meeting. Online check-in will start approximately thirty minutes before the meeting May 16, 202314, 2024 at 2:00 p.m. Pacific Time.

Whether or not you participate in the Annual Meeting, it is important that you vote your shares. We recommend that you submit your proxy card or voting instructions in advance of the Annual Meeting so that your vote will be counted even if you decide not to participate in the Annual Meeting. See below under “Q: How do I submit my vote?” for detailed instructions on how to submit your vote.

Q: Who can vote at the Annual Meeting?

A: Only stockholders of record at the close of business on the Record Date (March 21, 2023)19, 2024), will be entitled to vote at the Annual Meeting. On the Record Date, there were 45,663,52878,570,922 shares of Class A common stock outstanding and entitled to vote, 64,699,13660,071,226 shares of Class B common stock outstanding and entitled to vote, 41,056,42929,868,545 shares of Class C common stock outstanding and entitled to vote, and 12,411,4198,664,225 shares of Class D common stock outstanding and entitled to vote. Subsequent to the Record Date, our Sponsor exchanged 5,989,078 shares of Class C common stock (together with the corresponding Class A common units) and converted 2,010,922 shares of Class D common stock into shares of Class A common stock which were sold in the Offering. Upon the closing of the Offering on March 26, 2024, there were 86,570,922 shares of Class A common stock outstanding, 60,071,226 shares of Class B common stock outstanding, 23,879,467 shares of Class C common stock outstanding, and

Dutch Bros Inc.|

Dutch Bros Inc.| 20232024 Proxy Statement | 7

6,653,303 shares of Class D common stock outstanding. Notwithstanding the Offering, pursuant to our amended and restated bylaws and the Delaware General Corporation Law, the stockholders are entitled to vote the number of shares outstanding on the Record Date.

Q: How do I submit my vote?

A: You may vote “For” or “Against” or abstain from voting for each of the nominees to the Board on which you are entitled to vote. For the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2023,2024, you may vote “For” or “Against” or abstain from voting. For the selection,approval, on a non-binding, advisory basis, of the preferred frequency of stockholder advisory votes regarding compensation of our named executive officers, you may vote for “1 year,” “2 years,” “3 years”“For” or “Against” or abstain from voting. Even if you plan to attend the Annual Meeting, we recommend that you submit your proxy card or voting instructions prior to the Annual Meeting so that your vote will be counted if you later decide not to attend the Annual Meeting.

Voting Prior to the Annual Meeting:

To vote prior to the Annual Meeting until 8:59 p.m. Pacific Time on May 15, 2023,13, 2024, you may vote via the internet at www.proxyvote.com; by telephone; or by completing and returning your proxy card or voting instruction form, as described below:

• To vote using the proxy card, simply complete, sign and date the proxy card that you receive with your proxy materials and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct.

• To vote over the telephone, dial toll-free 1-800-690-6903 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the 16-digit Control Number provided to you on your Notice of Internet Availability of Proxy Materials that you received for the Annual Meeting. Your telephone vote must be received by until 8:59 p.m. Pacific Time on May 15, 2023,13, 2024, to be counted.

• To vote through the internet prior to the Annual Meeting, go to www.proxyvote.com and follow the instructions to submit your vote on an electronic proxy card. You will be asked to provide the 16-digit Control Number provided to you on your Notice of Internet Availability of Proxy Materials that you received for the Annual Meeting. For your vote to be counted in advance of the Annual Meeting, your internet vote must be received by until 8:59 p.m. Pacific Time on May 15, 2023.13, 2024.

Voting During the Annual Meeting:

To vote during the Annual Meeting, if you are a registered stockholder as of the Record Date and attending virtually, follow the instructions at www.virtualshareholdermeeting.com/BROS2023.BROS2024. You will need to enter the 16-digit Control Number found on your Notice of Internet Availability of Proxy Materials or in the email sending you the Proxy.

Q: What if I cannot find my Control Number?

A: If you cannot find your Control Number and you are the registered stockholder, please call the number listed on your Notice of Internet Availability of Proxy Materials. If you cannot find your Control Number and you are a beneficial stockholder, you may contact the bank, broker, or other institution where you hold your account if you have questions about obtaining your control number prior to the Annual Meeting. If you are unable to locate your 16-digit control number, you will be able to access and listen to the Annual Meeting but you will not be able to vote your shares or submit questions during the Annual Meeting.

Q: Will a list of stockholders of record as of the Record Date be available?

A: A list of our stockholders of record as of the close of business on the Record Date will be available for the ten days prior to the Annual Meeting at our headquarters at 110 SW 4th Street, Grants Pass, Oregon 97526. If you would like to view the list for a legally valid purpose, please contact us to schedule an appointment during ordinary business hours by emailing investors@dutchbros.com.

Dutch Bros Inc.|

Dutch Bros Inc.| 20232024 Proxy Statement | 8

Q: Where can we get technical assistance?

A: If you have difficulty accessing the Annual Meeting, please call the number listed on the stockholder login page at www.virtualshareholdermeeting.com/BROS2023,BROS2024, where technicians will be available to help you.

Q: For the Annual Meeting, how do we ask questions of management and the Board?

A: We plan to have a Q&A session at the Annual Meeting and will include as many appropriate stockholder questions as the allotted time permits. Stockholders may submit questions that are relevant to the business of the Annual Meeting in advance of the Annual Meeting as well as live during the Annual Meeting. If you are a stockholder, you may submit a question in advance of the meeting at www.proxyvote.com after logging in with your Control Number. Stockholders may submit questions during the Annual Meeting through www.virtualshareholdermeeting.com/BROS2023.BROS2024.

Q: What information is contained in this Proxy?

A: This Proxy contains information relating to the proposals to be voted on at the Annual Meeting, the voting process, and other required information.

Q: What proposals will be voted on at the Annual Meeting?

A: There are three proposals scheduled to be voted on at the Annual Meeting:

• election of nineeight director nominees, seven of whom will be elected by the holders of our Class A common stock, Class B common stock, Class C common stock, and Class D common stock, voting together as a single class, and twoone of whom will be elected by the holders of our Class C common stock, voting as a separate class, each to serve until our 20242025 annual meeting of stockholders;

• ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2023;2024; and

• selection,approval, on a non-binding, advisory basis, of the preferred frequency of stockholder advisory votes regarding compensation of our named executive officers.

We will also consider other business that properly comes before the Annual Meeting.

Q: How does the Board recommend that I vote?

A: The Board recommends that you vote your shares “FOR” the election of each of the Board’s nominees.

The Board recommends that you vote your shares “FOR” the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2023.2024.

The Board recommends that you vote your shares for“FOR” the approval, on a preferred frequencynon-binding, advisory basis, of “ONE YEAR” for non-binding, stockholder advisory votes regardingthe compensation of our named executive officers.

Q: What shares can I vote?

A: You may vote all shares of common stock that you owned as of the close of business on the Record Date (March 21, 2023)19, 2024).

The holders of Class A common stock, Class B common stock, Class C common stock, and Class D common stock vote together as a single class, other than for the election of two directors designated by our Sponsor,one director, where the holders of Class C common stock will vote as a separate class (in accordance with our amended and restated certificate of incorporation and our Stockholders Agreement, as described herein in the section titled “Other Matters—Transactions with Related Persons—Stockholders Agreement”).

Dutch Bros Inc.| 2023 Proxy Statement | 9

You have one vote for each share of Class A common stock, ten votes for each share of Class B common stock, three votes for each share of Class C common stock, and three votes for each share of Class D common stock you owned as of the Record Date (March 21, 2023)19, 2024). Holders of outstanding shares of our

Dutch Bros Inc.| 2024 Proxy Statement | 9

Dutch Bros Inc.| 2024 Proxy Statement | 9

Class A common stock, Class B common stock, Class C common stock, and Class D common stock will vote as a single class on all matters on which stockholders are entitled to vote generally, except as otherwise required by law or pursuant to the terms of our amended and restated certificate of incorporation. As of the Record Date (March 21, 2023)19, 2024), there were 45,663,52878,570,922 shares of Class A common stock outstanding, 64,699,13660,071,226 shares of Class B common stock outstanding, 41,056,42929,868,545 shares of Class C common stock outstanding, and 12,411,4198,664,225 shares of Class D common stock outstanding, all of which are entitled to be voted at the Annual Meeting.

Q: What is the difference between being a registered stockholder and a beneficial owner?

A: Many of our stockholders hold their shares through stockbrokers, banks, or other nominees, rather than directly in their own names. As summarized below, there are some differences between being a registered stockholder and a beneficial owner.

Registered Stockholder: If your shares are registered directly in your name with our transfer agent, American Stock Transfer &Equiniti Trust Company, LLC, you are the registered stockholder, and these proxy materials are being sent directly to you. As the registered stockholder, you have the right to grant your voting proxy directly to us and to vote at the Annual Meeting.

Beneficial Owner: If your shares are held in a stock brokerage account or by a bank or other nominee, you are the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you by your broker or other nominee, who is considered to be the registered stockholder. As the beneficial owner, you have the right to tell your nominee how to vote, and you are also invited to attend the Annual Meeting. However, since you are not the registered stockholder, you may not vote your shares at the Annual Meeting unless you obtain a legal proxy from your nominee authorizing you to do so. Your nominee has sent you instructions on how to direct the nominee’s vote. You may vote by following those instructions and the instructions on the Notice of Internet Availability of Proxy Materials.

Q: Can I change my vote or revoke my proxy?

A: Yes, you can change your proxy instructions at any time before the vote at the Annual Meeting, by:

For Registered Stockholders (shares registered in your own name):

• Entering a new vote online;

• Entering a new vote by telephone;

• Mailing a written notice of revocation to our Corporate Secretary at our address below, or

• Signing and returning a new proxy card bearing a later date, which will automatically revoke your earlier proxy instructions.

For Beneficial Owners (shares registered in the name of broker or bank):

•If your shares are held by your broker, bank, or other nominee, you should follow the instructions provided by your broker, bank, or other nominee.

Q: What constitutes a quorum?

A: A quorum of stockholders is necessary to hold a valid meeting. The holders of a majority of the voting power of the outstanding shares of stock as of the Record Date who are entitled to vote at the Annual Meeting and present in person, by remote communication, or represented by proxy duly authorized at the Annual Meeting, shall constitute a quorum. Abstentions and broker non-votes (as described below) are counted as present for the purpose of determining a quorum. As of the Record Date (March 21, 2023)19, 2024),

Dutch Bros Inc.| 2023 Proxy Statement | 10

there were 45,663,52878,570,922 shares of Class A common stock outstanding, with one vote per share, 64,699,13660,071,226 shares of Class B common stock outstanding, with ten votes per share, 41,056,42929,868,545 shares of Class C

Dutch Bros Inc.| 2024 Proxy Statement | 10

Dutch Bros Inc.| 2024 Proxy Statement | 10

common stock outstanding, with three votes per share, and 12,411,4198,664,225 shares of Class D common stock outstanding, with three votes per share, all of which are entitled to be voted at the Annual Meeting.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank, or other nominee) or if you vote online at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the holders of a majority (in voting power) of shares present at the meeting or represented by proxy may adjourn the meeting to another date.

Q: What is a broker non-vote?

A: If you hold shares beneficially in street name and do not provide your broker with specific voting instructions, your shares may constitute “broker non-votes.” Under the rules of the New York Stock Exchange (NYSE), brokers, banks, and other securities intermediaries that are subject to NYSE rules may use their discretion to vote your “uninstructed” shares with respect to matters considered to be “routine” under NYSE rules, but not with respect to “non-routine” matters. In this regard, Proposals 1 and 3 are considered to be “non-routine” under NYSE rules, meaning that your broker may not vote your shares on those proposals in the absence of your voting instructions. However, Proposal 2 is considered to be a “routine” matter under NYSE rules, meaning that if you do not return voting instructions to your broker by its deadline, your shares may be voted by your broker in its discretion on Proposal 2. Generally, broker non-votes occur on a matter when a broker is not permitted to vote on that matter without your specific instruction. Broker non-votes are counted for quorum purposes but not in counting votes cast for, or entitled to vote on, a proposal.

If you are a beneficial owner of shares held in street name, and you do not plan to attend the Annual Meeting, in order to ensure your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank, or other nominee by the deadline provided in the materials you receive from your broker, bank, or other nominee.

Q: What is a proxyholder?

A: We are designating Charles L. Jemley, our Chief Financial Officer, and Victoria Tullett, our Chief Legal Officer and Corporate Secretary and Joshua Lute, our Vice President of Employment and Franchise Law and Assistant Corporate Secretary, to hold and vote all properly tendered proxies. If you have indicated a vote, they will so vote. If you have left a vote blank, they will vote as the Board recommends.

While we do not expect any other business to come up for vote, if it does, they will vote in their discretion. If a director nominee is unwilling or unable to serve, the proxyholders will vote in their discretion for an alternative nominee.

Q: What does it mean if I receive more than one Notice of Internet Availability of Proxy Materials?

A: You may receive more than one Notice of Internet Availability of Proxy Materials, if, for example, you hold your shares in more than one name or in different brokerage accounts. You must vote based on the instructions in each Notice of Internet Availability of Proxy Materials separately.

Q: How are votes counted?

A: Broadridge Financial Solutions, Inc., has been appointed to be the inspector of elections, to act at the meeting, to make a written report thereof, to take charge of the polls, and to make a certificate of the result of the vote taken.

NineEight director nominees are to be elected at the Annual Meeting. The holders of Class C common stock, voting as a separate class, are entitled to elect one member of the Board. The holders of Class A common stock, Class B common stock, Class C common stock, and Class D common stock, voting together as a single class, are entitled to elect seven members of the Board. The holders of Class C common stock, voting as a separate class, are entitled to elect tworemaining members of the Board. Our stockholders do not have any right to vote cumulatively in any election of directors. Directors elected by the holders of the Class A common

Dutch Bros Inc.| 2023 Proxy Statement | 11

stock, Class B common stock, Class C common stock, and Class D common stock must

Dutch Bros Inc.| 2024 Proxy Statement | 11

Dutch Bros Inc.| 2024 Proxy Statement | 11

receive “For” votes from the holders of a majority of votes present virtually or represented by proxy and entitled to vote on the matter (i.e., the number of votes cast “For” a nominee’s election must exceed the number of votes cast “Against” that nominee’s election). DirectorsThe director elected by the holders of Class C common stock must receive “For” votes from the holders of a majority of Class C common stock votes present virtually or represented by proxy and entitled to vote on the matter. If you “Abstain” from voting, it will have no effect.

To be approved, Proposal No. 2, ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2023,2024, must receive “For” votes from the holders of a majority of votes present virtually or represented by proxy and entitled to vote on the matter. If you “Abstain” from voting, it will have the same effect as an “Against” vote.

To be approved, Proposal No. 3, selection,approval, on a non-binding, advisory basis, of the preferred frequency of stockholder advisory votes regarding compensation of our named executive officers, a single frequency must receive “For” votes from the holders of a majority of votes present virtually or represented by proxy and entitled to vote on the matter. Because there are multiple frequency options presented, it is possible that no frequency will receive a majority. In such case, we will consider the frequency option that received the most votes present virtually or represented by proxy and entitled to vote on the matter to be the frequency selected. If you “Abstain” from voting, it will have no effect.the same effect as an “Against” vote.

We will announce preliminary results at the meeting and publish final voting results on a Current Report on Form 8-K that we expect to file with the SEC within four business days after the end of the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

Q: Is my vote confidential?

A: Proxy instructions, ballots, and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed, either within Dutch Bros or to third parties, except as necessary (i) to meet applicable legal requirements, (ii) to allow for tabulation and certification of the vote, and (iii) to facilitate successful proxy solicitation by the Board.

Q: Who bears the cost of soliciting votes for the Annual Meeting?

A: We bear the entire cost of preparing, assembling, printing, mailing, and distributing these proxy materials. The solicitation of proxies or votes may be made in person, by telephone, and by electronic communication by our directors, officers, and employees, who will not receive any additional compensation for these solicitation activities. In addition, we may reimburse brokerages and other entities that represent beneficial owners for their expenses in forwarding solicitation materials to beneficial owners.

Q: How can I submit a stockholder proposal or director nomination for next year’s annual meeting?

A: Stockholders may present proper proposals for inclusion in our proxy statement for next year and for consideration at next year’s annual meeting of stockholders by submitting their proposals in writing to our Corporate Secretary in a timely manner.

For a stockholder proposal or director nomination to be considered for inclusion in our proxy materials for next year’s annual meeting, our Corporate Secretary must receive the written proposal at our principal executive offices at the corporate address provided below not later than December 5, 2023.2, 2024. In the event that we hold next year’s annual meeting more than 30 days before or after the one-year anniversary of this year’s Annual Meeting (i.e., before April 16, 2024,14, 2025, or after June 15, 2024)13, 2025), notice of a stockholder proposal must be received by our Corporate Secretary a reasonable time before we begin to print and send our proxy materials. In addition, stockholder proposals must comply with the requirements of Rule

Dutch Bros Inc.| 2023 Proxy Statement | 12

14a-8 under the Exchange Act, regarding the inclusion of stockholder proposals in company-sponsored proxy materials.

Dutch Bros Inc.| 2024 Proxy Statement | 12

Dutch Bros Inc.| 2024 Proxy Statement | 12

If a stockholder wishes to submit a nomination or proposal, which will not be included in our proxy materials, for consideration at next year's annual meeting, our amended and restated bylaws establish an advance notice procedure. Pursuant to our amended and restated bylaws, the only business that may be conducted at an annual meeting of stockholders is business that is (i) specified in our proxy materials with respect to such annual meeting, (ii) otherwise properly brought before such annual meeting by or at the direction of our Board, or (iii) properly brought before such meeting by a stockholder of record entitled to vote at such annual meeting who has delivered timely written notice to our Corporate Secretary, which notice must contain the information specified in our amended and restated bylaws. To be timely for next year’s annual meeting, our Corporate Secretary must receive the written notice at our principal executive offices at the corporate address provided below:

•not earlier than the close of business on January 17, 202414, 2025 (120 days before the anniversary of this year’s Annual Meeting); and

•not later than the close of business on February 16, 202413, 2025 (90 days before the anniversary of this year’s Annual Meeting).

In the event that we hold next year’s annual meeting more than 30 days before or after the one-year anniversary of this year’s Annual Meeting, notice of a stockholder proposal that is not intended to be included in our proxy statement next year must be received by our Corporate Secretary not earlier than the close of business on the 120th day prior to such annual meeting and not later than the close of business on the later of the 90th day prior to such annual meeting or the 10th day following the day on which public announcement of the date of such annual meeting is first made.

If a stockholder who has notified us of their intention to present a proposal at an annual meeting of stockholders does not appear to present their proposal at such annual meeting, we are not required to present the proposal for a vote at such annual meeting.

In addition to satisfying the foregoing requirements under our amended and restated bylaws, to comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than Dutch Bros’ nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act no later thanthan March 17, 2024.15, 2025.

Q: Can I recommend director candidates directly to Dutch Bros?

A: Yes, our Board will consider director candidates recommended for nomination by our stockholders during such times as they are seeking proposed nominees to stand for election at the next annual meeting of stockholders (or, if applicable, a special meeting of stockholders). Our stockholders that wish to nominate a director for election to our board of directors should follow the procedures set forth in our amended and restated bylaws.

Q: Can I communicate with the Board?

A: Yes, any stockholder or other interested party may write to the Board at our address below or by email at investors@dutchbros.com.

Q: What is your corporate address for notice and Board communication purposes?

Dutch Bros Inc.

Attention: Corporate Secretary

110 SW 4th Street

Grants Pass, Oregon 97526

Dutch Bros Inc.| 2023 Proxy Statement | 13

Q: What should I do if my household receives one copy of proxy materials and I need an additional copy?

A: We have adopted a procedure called "householding," which is approved by the SEC and permits the delivery of a single Notice of Internet Availability of Proxy Materials and, if applicable, one copy of the

Dutch Bros Inc.| 2024 Proxy Statement | 13

Dutch Bros Inc.| 2024 Proxy Statement | 13

proxy materials, to multiple stockholders sharing an address. Stockholders who participate in householding will continue to access and receive separate proxy cards. If one Notice of Internet Availability of Proxy Materials or set of other proxy materials is delivered to two or more stockholders who share an address, upon written or oral request we will promptly deliver a separate copy of such materials to a stockholder at a shared address. Please contact our agent using the information provided on the Notice of Internet Availability of Proxy Materials, or us at our offices at the address above, if you wish to receive a separate copy of any proxy materials, or if one household that is currently receiving multiple copies wishes to receive only a single copy of each of these documents for your household, please contact Broadridge Financial Solutions Inc. by calling their toll free number, 1-866-540-7095 or in writing at 51 Mercedes Way, Edgewood, NY 11717, Attention: Householding Department. If in the future you wish to receive separate copies of our proxy materials, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank, broker, or other nominee record holder, or you may contact us at our office at the address above.

Dutch Bros Inc.|

Dutch Bros Inc.| 20232024 Proxy Statement | 14

BOARD OF DIRECTORS MATTERS

PROPOSAL 1: ELECTION OF DIRECTORS

Our business and affairs are managed under the direction of our Board. We currently have nineeight directors with no vacancies. one vacancy following the resignation of Blythe Jack on March 22, 2024 in connection with the Offering and in accordance with our amended and restated certificate of incorporation and the Stockholders Agreement. Ms. Jack is not standing for re-election at the Annual Meeting. The Board thanks Ms. Jack for her guidance and dedicated service.

There are nineeight nominees for director this year, seven of whom will be elected by the holders of our Class A common stock, Class B common stock, Class C common stock, and Class D common stock, voting together as a single class, and twoone of whom will be elected by the holders of our Class C common stock, voting as a separate class. Directors are elected annually by a majority of eligible votes cast on each director’s election. ifAs a result of Ms. Jack’s resignation, there will be one vacancy following the Annual Meeting. If you “Abstain” from voting, it will have no effect. This matter is non-routine, thus, if you hold your shares in street name, your broker may not vote your shares for you.

Our amended and restated certificate of incorporation and our amended and restated bylaws permit our Board to establish the authorized number of directors from time to time by resolution. Our amended and restated certificate of incorporation permits the holders of our Class C common stock, voting as a separate class, to elect up to two members to the Board subject to certain limitations set forth therein. We have also entered into the Stockholders Agreement with investment funds affiliated with our Sponsor which provides that investment funds affiliated with our Sponsor will have the right to designate up to two of the directors serving on our Board. Subsequent to the Record Date, our Sponsor exchanged and sold 5,989,078 shares of Class C common stock (together with the corresponding Class A common units) and converted 2,010,922 shares of Class D common stock into shares of Class A common stock which were sold in the Offering. Upon the closing of the Offering, the total number of outstanding shares of the Class C common stock and Class D common stock was less than 50% of the total number of shares of our Class C common stock and Class D common stock outstanding immediately prior to the closing of our IPO. In accordance with our amended and restated certificate of incorporation, the holders of Class C common stock only be entitled to vote as a separate class on one director at the Annual Meeting notwithstanding the fact that the holders of Class C common stock are entitled to vote the number of shares of Class C common stock held by them and outstanding on the Record Date. See “Other Matters—Transactions with Related Persons—Stockholders Agreement.”

All of the directors were last elected as members of our Board at our 20222023 annual meeting of stockholders, with the exception of Ann M. Miller,C. David Cone and Sean Sullivan, who were appointed to our Board in November 2023 to fill the vacancies created by the resignations of Shelley Broader and Charles Esserman, and Christine Barone, who was appointed to our Board in August 2022.January 2024 to fill the vacancy created by the resignation of Jonathan “Joth” Ricci. Each of the nominees listed below is currently a director of Dutch Bros. If elected at the Annual Meeting, each of these nominees would serve until the 20242025 annual meeting and until his or her successor has been duly elected and qualified, or, if sooner, until the director’s death, resignation or removal. It is Dutch Bros’ policy to encourage directors and nominees for director to attend the Annual Meeting. Vacancies and newly created directorships on the Board will be filled as provided in the amended and restated certificate of incorporation, except as otherwise required by applicable law.

Dutch Bros Inc.| 2024 Proxy Statement | 15

Dutch Bros Inc.| 2024 Proxy Statement | 15

Vote Required

One of our directors is elected by the holders of Class C common stock and must receive “For” votes from the holders of a majority of Class C common stock votes present virtually or represented by proxy and entitled to vote on the matter. The remaining directors are elected by the holders of the Class A common stock, Class B common stock, Class C common stock, and Class D common stock and must receive “For” votes from the holders of a majority of the Class A common stock, Class B common stock, Class C common stock, and Class D common stock votes present virtually or represented by proxy and entitled to vote on the matter (i.e., the number of votes cast “For” a nominee’s election must exceed the number of votes cast “Against” that nominee’s election).

| | | | | | | | |

| | RECOMMENDATION OF THE BOARD |

| ☑ | | |

| The Board of Directors recommends that you vote “FOR” the election of each of the following director nominees for the class or classes of common stock that you hold. |

Dutch Bros Inc.| 2023 Proxy Statement | 15

Nominees to be elected by the holders of our Class A common stock, Class B common stock, Class C common stock, and Class D common stock:

| | | | | | | | | | | |

| | Travis Boersma Co-founder and Executive Chairman of the Board | Age: 5253 |

| | |

| Skills & Expertise: •Industry Experience •Brand Marketing Experience •Operations & Distribution Experience •Senior Leadership Experience | Committees: None |

| |

| Classes of Common Stock to Elect: Class A, B, C, and D common stock |

|

|

Mr. Boersma is our Co-Founder and has served as our Executive Chairman since August 2021 and as the Executive Chairman of Dutch Bros OpCo since February 2021. Prior to serving as our Executive Chairman, he served as the Chief Executive Officer of Dutch Bros OpCo from February 2019 to February 2021. Mr. Boersma has led us as Co-Founder since 1992. Mr. Boersma attended Southern Oregon University. We believe that Mr. Boersma’s experience as our co-Founder and his industry knowledge, as well as his leadership experience, make him an appropriate member of our Board.

Dutch Bros Inc.| 2024 Proxy Statement | 16

Dutch Bros Inc.| 2024 Proxy Statement | 16

| | | | | | | | | | | |

| | Jonathan “Joth” RicciChristine Barone

Chief Executive Officer and Director | Age: 5550 |

| | |

| Skills & Expertise: •Industry Experience •Brand Marketing Experience •Operations & Distribution Experience •Public Company Board Experience •Senior Leadership Experience | Committees: None |

| |

| Classes of Common Stock to Elect: Class A, B, C, and D common stock |

|

|

Mr. RicciMs. Barone has served as our Chief Executive Officer and as a member of our board of directorsBoard since August 2021,January 2024, and as our President from August 2021 tosince February 2023,2023. Ms. Barone has worked in the food service and beverage industries for more than a decade, and most recently served as Chief Executive Officer of Dutch Bros OpCo since February 2021,at True Food Kitchen, a high growth restaurant and the President of Dutch Bros OpColifestyle brand, from January 2019August 2016 to February 2023. Prior to that, she served in various leadership roles at Starbucks Corporation (Nasdaq: SBUX). Earlier in her career, she held positions with Bain & Company and Raymond James. Since JanuaryMarch 2020, Mr. Ricci has served as Chairman of the board of directors of Dutch Bros Foundation, our philanthropic arm. From April 2017 to January 2019, he served as President and Chief Executive Officer of Adelsheim Vineyard. From February 2013 to April 2017, Mr. Ricci served as President of Stumptown Coffee Roasters, a coffee company. In addition to his senior management experience, Mr. RicciMs. Barone has served on various boardsthe Board of directorsDirectors of Yelp Inc. Ms. Barone holds a B.A. in the beverage industryApplied Mathematics and civic organizations since January 2012. Mr. Ricci received a B.S. in Business Educationan M.B.A. from Oregon StateHarvard University. We believe Mr. Ricci’sthat Ms. Barone’s extensive leadership experience and knowledge ofexpertise in our industry, operations, and brand marketing make himher an appropriate member of our Board.

Dutch Bros Inc.| 2023 Proxy Statement | 16

| | | | | | | | | | | |

| | Shelley Broader

Director

| Age: 58

|

| | |

| Skills & Expertise:

•Financial/Capital Allocation Experience

•Operations & Distribution Experience

•Public Company Board Experience

•Senior Leadership Experience

| Committees: Audit and Risk (Chair)

|

| |

| Classes of Common Stock to Elect: Class A, B, C, and D common stock

|

|

|

Ms. Broader has served as a member of our Board since August 2021. Ms. Broader served as Chief Executive Officer and President of Chico’s FAS, Inc., a fashion retailer, from December 2015 to April 2019. Prior to this, Ms. Broader served as Executive Vice President at Walmart Inc. (NYSE: WMT), a multinational retail company, from 2009 to November 2015 in various executive roles, including as President and Chief Executive Officer of the Walmart Europe, Middle East, and Sub-Saharan Africa region from July 2014 to October 2015, President and Chief Executive Officer of Walmart Canada Corp. from September 2011 to May 2014, Chief Merchandising Officer of Walmart Canada Corp. from 2010 to 2011, and Senior Vice President for Sam’s Club (a division of Walmart) from 2009 to 2010. In addition, Ms. Broader served as President and Chief Operating Officer for Michaels Stores, Inc. from 2008 to 2009, President and Chief Operating Officer for Sweetbay Supermarket from 2003 to 2008, and Senior Vice President and in various executive roles for Hannaford Bros Co. from 1991 to 2003. Ms. Broader previously served on the board of directors of Chico’s FAS, Inc. (NYSE: CHS) from December 2015 to April 2019 and Raymond James Financial, Inc. (NYSE: RJF) from February 2008 to February 2020. Ms. Broader is a member of the board of directors of Inspire Medical Systems, Inc. (NYSE: INSP) and Loblaw Companies Ltd. (TSX:L), IFCO Systems, and the Moffitt Cancer Center’s National Board of Advisors. Ms. Broader holds a B.A. from Washington State University. We believe Ms. Broader’s C-suite leadership experience at a multitude of leading multinational brands make her an appropriate member of our Board.

| | | | | | | | | | | |

| | Thomas Davis Director | Age: 4546 |

| | |

| Skills & Expertise: •Financial/Capital Allocation Experience •Senior Leadership Experience | Committees: Compensation (Chair) |

| |

| Classes of Common Stock to Elect: Class A, B, C, and D common stock |

|

|

Mr. Davis has served as a member of our Board since August 2021 and a member of the board of managers for Dutch Bros OpCo since October 2018. Since January 2023, Mr. Davis has served as a Partner of Brown Brothers Harriman & Co. (BBH), a privately owned financial services firm, where he oversees the New York, Latin America, and Chicago Private Banking offices, and where he previously served as a Managing Director since October 2012. Mr. Davis also serves as a member of the Private Banking Oversight Committee and the Private Banking Investment Oversight Committee. From July 2007 to August 2012, he served as a Vice President in the Investment Management division of The Goldman Sachs Group, Inc., a publicly-traded global investment banking, securities, and investment management firm. Mr. Davis received an M.B.A. from the Mendoza College of Business at the University of Notre Dame and a B.B.A. from the University of San Diego. We believe that Mr. Davis’sDavis’ extensive leadership experience and expertise in strategy, finance, and management make him an appropriate member of our Board.

Dutch Bros Inc.|

Dutch Bros Inc.| 20232024 Proxy Statement | 17

| | | | | | | | | | | |

| | Kathryn George Director | Age: 5859 |

| | |

| Skills & Expertise: •Financial/Capital Allocation Experience •Senior Leadership Experience | Committees: Audit and RiskNone |

| |

| Classes of Common Stock to Elect: Class A, B, C, and D common stock |

|

|

Ms. George has served as a member of our Board since August 2021 and a member of the board of managers for Dutch Bros OpCo since October 2018. Since January 1, 2008, Ms. George has served as a Partner of BBH, a privately owned financial services firm, where she has worked for 37 years. Prior to assuming a leadership role in BBH’s Private Banking business in 2015, she served as Chief Administrative Officer for over five years with responsibility for Global Audit, Risk, Compliance, Human Resources, and the Office of General Counsel. Ms. George currently serves as Chair of the Private Banking Investment Oversight Committee, Co-Chair of the Global Inclusion Council, and as a member of the Private Banking Oversight Committee, the Capital Partners Investment and Valuation Committee, and the Governance Risk and Compliance Committee. She is also on the board of the Brown Brothers Harriman Trust Company NA and the Brown Brothers Harriman Trust Company (Cayman) Limited. Since joining Brown Brothers Harriman & Co. in August 1986, she previously served in multiple positions, including Head of Merchant Banking and of Equity, Sales, Research, and Trading. Since September 2016, Ms. George has served as a member of the board of directors of Haven Behavioral Healthcare, Inc., a healthcare company. Since 2014, she has served as a trustee and member of the Governance Committee of Trinity College. Since 2012, Ms. George has served as Chairman of the Board of Trustees of the Gillen Brewer School. She is a former Member of the Executive Committee of the Episcopal High School in Alexandria, Virginia, where she chaired the Investment Committee. Ms. George received a B.A. in Economics from Trinity College where she was elected to Phi Beta Kappa. We believe that Ms. George’s extensive leadership experience and expertise in strategy, finance, and management make her an appropriate member of our Board.

Dutch Bros Inc.|

Dutch Bros Inc.| 20232024 Proxy Statement | 18

| | | | | | | | | | | |

| | Stephen Gillett Director | Age: 4748 |

| | |

| Skills & Expertise: •Financial/Capital Allocation Experience •Brand Marketing Experience •Operations & Distribution Experience •Technology Experience •Public Company Board Experience •Senior Leadership Experience | Committees: Audit and Risk (Chair), Nominating and Governance |

| |

| Classes of Common Stock to Elect: Class A, B, C, and D common stock |

|

|

Mr. Gillett has served as a member of our Board since December 2021. Since January 2023, Mr. Gillett has served as Chief Executive Officer of Verily Life Sciences LLC (formerly, Google Life Sciences), a life sciences and technology company, where he previously served as Chief Operating Officer from November 2020 to January 2023, and as Executive Advisor from May 2020 to November 2020. Since June 2019, Mr. Gillett has served as Advisor of X Development, LLC (formerly, GoogleX), a research and development company, and since December 2016, Mr. Gillett has served as an Advisor of GV (formerly, Google Ventures) a venture capital investment company. From September 2019 to May 2020, Mr. Gillett served as Executive Advisor to the CEO of Alphabet Inc. (NASDAQ: GOOGL, GOOG), a multinational technology conglomerate holding company, and its subsidiary, Google LLC. From March 2017 to October 2021, Mr. Gillett served as Chief Executive Officer of Chronicle, a cybersecurity company that he co-founded that was later acquired by Google Cloud in June 2019. Since June 2020, Mr. Gillett has served as a member of the board of directors of Discord Inc., a communication company focused on developing an online voice, video, and text communication platform, where he also serves as Chair of the Nominating and Governance Committee. From March 2015 to May 2017, Mr. Gillett served as a member of the board of directors of Chipotle Mexican Grill, Inc. (NYSE: CMG), a multinational fast casual restaurant company, where he also served as a member of the Audit and Nominating and Governance Committees. Mr. Gillett also served as member of the board of directors of Symantec Corporation from 2011 to 2012, where he also served as EVP, and Chief Operating Officer from December 2012 to July 2015 prior to its acquisition by Broadcom, Inc. Mr. Gillett received an M.B.A. from San Francisco State University and a B.S. from the University of Oregon. We believe that Mr. Gillett’s extensive leadership experience and expertise in technology, retail, strategy, and management make him an appropriate member of our Board.

Dutch Bros Inc.|

Dutch Bros Inc.| 20232024 Proxy Statement | 19

| | | | | | | | | | | |

| | Ann M. Miller Director | Age: 4849 |

| | |

| Skills & Expertise: •Financial/Capital Allocation Experience •Brand Marketing Experience •Operations & Distribution Experience •Senior Leadership Experience | Committees: Nominating and Governance (Chair), Audit and Risk |

| |

| Classes of Common Stock to Elect: Class A, B, C, and D common stock |

|

|

Ms. Miller has served as a member of our Board since August 2022. Since February 2022, Ms. Miller has served as Executive Vice President and Chief Legal Officer of NIKE, Inc. (NYSE: NKE), a multinational athletic footwear, apparel, equipment, and services corporation. She has previously served for more than 15 years in various other roles at NIKE, most recently as Vice President, Corporate Secretary and Chief Ethics & Compliance Officer from November 2016 to February 2022. Ms. Miller is a practicing attorney and a member of the bar in New York, California, District of Columbia, and Oregon. She received a J.D. summa cum laude from University of Arizona College of Law and a B.A. in History from Smith College. We believe her extensive experience in advising public companies on business, securities, and corporate governance matters make her an appropriate member of our Board.

Nominees | | | | | | | | | | | |

| | C. David Cone Director | Age: 52 |

| | |

| Skills & Expertise: •Financial/Capital Allocation Experience •Senior Leadership Experience | Committees: Audit and Risk |

| |

| Classes of Common Stock to Elect: Class A, B, C, and D common stock |

|

|

C. David Cone has served as a member of our Board since November 2023. From October 2021 to December 2021, he served as Chief Financial Officer and Executive Vice President at Taylor Morrison Home Corporation (NYSE: TMHC), a residential homebuilding business and land developer. Prior to that, he held various roles at PetSmart, Inc. from 2003 to 2012, while the company was publicly-listed, most recently as Vice President, Finance Planning and Analysis. Mr. Cone previously served on the board of directors for Urbi Desarrollos Urbanos SAB DE CV. He received a B.A. in Business Economics with an emphasis in Accounting from the University of California at Santa Barbara. We believe Mr. Cone’s extensive experience in strategy, finance, and management, make him an appropriate member of our Board.

Dutch Bros Inc.| 2024 Proxy Statement | 20

Dutch Bros Inc.| 2024 Proxy Statement | 20

Nominee to be elected by the holders of our Class C common stock:

| | | | | | | | | | | |

| | Charles EssermanSean Sullivan

Director | Age: 6443 |

| | |

| Skills & Expertise: •Industry Experience

•Public Company Board Experience

•Senior Leadership Experience

| Committees: None

|

| |

| Class of Common Stock to Elect: Class C common stock

|

|

|

Mr. Esserman has served as a member of our Board since August 2021 and a member of the board of managers for Dutch Bros OpCo since October 2018. Mr. Esserman serves as the Chief Executive Officer of TSG Consumer Partners, L.P., a private equity firm specializing in the consumer products industry that he co-founded in 1987. He also serves as Chair of the Investment Committee. Since October 2016, he has served as a member of the board of directors of Duckhorn Portfolio, Inc., a luxury wine company (NYSE: NAPA). From November 2012 to November 2017, Mr. Esserman served as a member of the board of directors of Planet Fitness, Inc., a company focused on franchising and operating fitness centers (NYSE: PLNT). From July 2012 to January 2018, he served on the Board of Trust of Vanderbilt University. Mr. Esserman received an M.B.A. from Stanford University and a B.S., with top honors, in Computer Science Engineering from the Massachusetts Institute of Technology. We believe that Mr. Esserman’s extensive experience in portfolio investments and consumer brands make him an appropriate member of our Board.

Dutch Bros Inc.| 2023 Proxy Statement | 20

| | | | | | | | | | | |

| | Blythe Jack

Director

| Age: 48

|

| | |

| Skills & Expertise:

•Brand Marketing Experience •Senior Leadership Experience | Committees:CompensationNone |

| |

| Class of Common Stock to Elect: Class C common stock |

|

|

Ms. JackSean Sullivan has served as a member of our Board since August 2021 and a member of the board of managers for Dutch Bros OpCo since October 2018. From 2011 to January 2023, Ms. Jack served at TSG Consumer Partners, L.P., a private equity company, most recently as Managing Director and a member of the Investment Committee.November 2023. Since April 2017, sheFebruary 2019, he has served as the Executive Vice President, Chief Strategy and Legal Officer of The Duckhorn Portfolio, Inc., a member ofUS-based wine company, where he leads the board of directors of BrewDog plc, a global independent craft brewing company. Since July 2015, she has served as a member of the board of directors of Backcountry.com, LLC, a retail company specializing in outdoor gearstrategy and apparel.legal teams. From June 2016 to March 2021, Ms. Jack served as a member of the board of directors of Canyon Bicycles GmbH, a direct-to-consumer bicycle company. From April 2014 to December 2020, she served as a member of the board of directors of SweetWater Brewing Company, a craft brewing company. From July 2018 to February 2020, Ms. Jack served as a member of the board of directors of Prive Goods, LLC, a designer eyewear company. From October 2012 to August 2016, she served as a member of the board of directors of IT Cosmetics, LLC, a beauty company.January 2019, Mr. Sullivan was an attorney at Gibson, Dunn & Crutcher LLP, an international law firm. Prior to joining TSG Consumer Partners, L.P., Ms. Jack servedthat, Mr. Sullivan worked as a Managing Director of Rosewood Capital, LP, aan investment banker in Credit Suisse Group AG’s technology, media and telecom group, where he specialized in structuring public and private equity company. Ms. Jackcompany acquisitions and divestitures. Mr. Sullivan received a J.D. from Columbia Law School and B.A., with honors, in Communication Studieseconomics and politics from Vanderbilt University.St. Mary’s College of California. We believe that Ms. Jack’sMr. Sullivan’s extensive experience in portfolio investmentsmanagement and consumer brands and expertise in strategy and managementadvising public companies on a variety of strategic matters make herhim an appropriate member of our Board.

Director Skills, Experience, and Background

Listed below are the skills and experience that we consider important for our directors in light of our current business and structure. The directors’ biographies note each director’s relevant experience, qualifications, and skills relative to this list.

Industry Experience

As a high growth operator and franchisor of drive-thru beverage shops, we seek directors who have sufficient knowledge and experience in the consumer products, retail, food, and beverage industries, which is useful in understanding our product development, offerings, and growth strategies.

Financial/Capital Allocation Experience

We believe it is important that we have directors with senior financial leadership experience at large organizations and/or financial equity firms who are experienced in allocating capital to aide our success.

Brand Marketing Experience

We believe it is important for our directors to have brand marketing experience because of the importance of image and reputation in the beverage business as we continue to expand our footprint to become a recognized and respected brand.

Operations & Distribution Experience

As we continue our growth strategy of expansion to new markets, we believe it is important for our directors to have experience in large organization operations and varying distribution channels.

Dutch Bros Inc.|

Dutch Bros Inc.| 20232024 Proxy Statement | 21

Technology Experience

As we continue our growth strategy of expansion to new markets, and providing a unique experience to our customers, the level of technology resources and infrastructure we use becomes more essential. We believe it is important to have directors with technological expertise to provide insight and perspective on these advancements.

Public Company Board Experience

Directors that have served on other public company boards offer diverse perspectives with regards to board dynamics and operations, relationships between the board and Dutch Bros Inc. management, and other matters.

Senior Leadership Experience

We believe that it is important for our directors to have senior leadership experience, as they are uniquely positioned to contribute practical insight into business strategy and operations, and support the achievement of strategic priorities and objectives.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Travis Boersma | | Jonathan “Joth” RicciChristine Barone | | Shelley Broader | | Thomas Davis | | Kathryn George | | Stephen Gillett | | Ann M. Miller | | Charles EssermanC. David Cone | | Blythe JackSean Sullivan |

| Industry Experience | | ✓ | | ✓ | | | | | | | | | | | | | ✓ | |

| Financial/Capital Allocation Experience | | | | | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | | | |

| Brand Marketing Experience | | ✓ | | ✓ | | | | | | | | ✓ | | ✓ | | | | ✓ |

| Operations & Distribution Experience | | ✓ | | ✓ | | | | | | ✓ | | | | | | ✓ | | | ✓ | | | |

| Technology Experience | | | | | | | | | | | | ✓ | | | | | | |

| Public Company Board Experience | | | | ✓ | | | | | | ✓ | | | | | | | ✓ | | | ✓ | | |

| Senior Leadership Experience | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ |

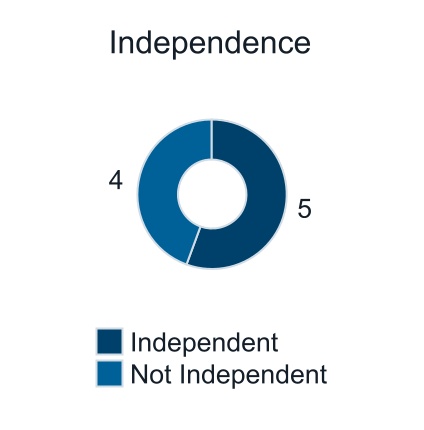

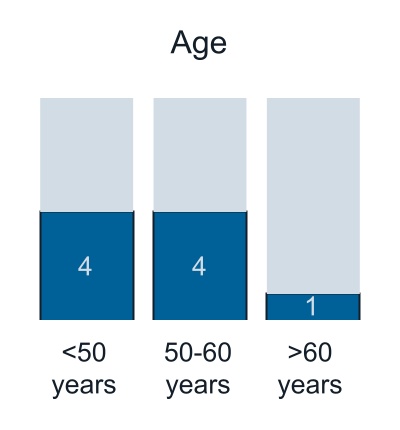

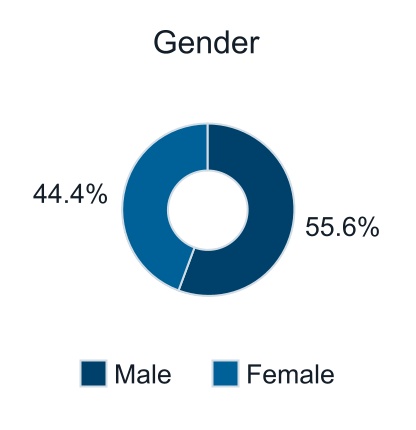

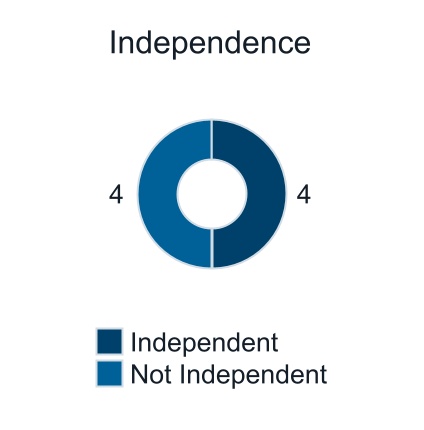

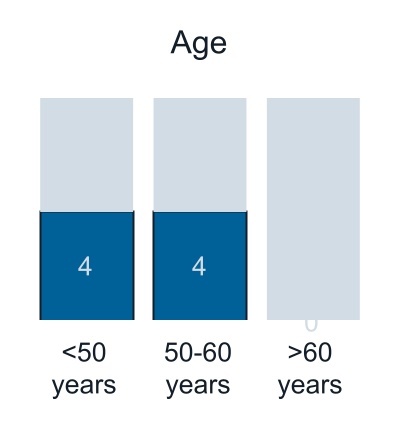

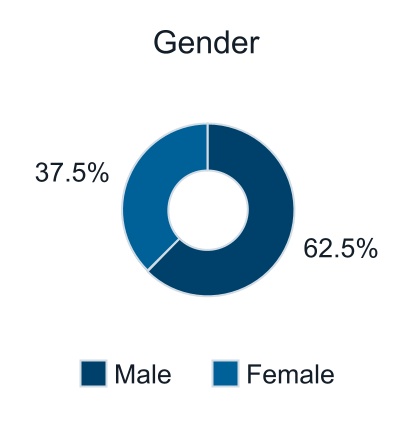

Board Diversity

Dutch Bros Inc.|

Dutch Bros Inc.| 20232024 Proxy Statement | 22

CORPORATE GOVERNANCE MATTERS

Composition of Our Board of Directors

Our business and affairs are managed under the direction of our Board. Our amended and restated certificate of incorporation and our amended and restated bylaws permit our Board to establish the authorized number of directors from time to time by resolution. Each director serves until the expiration of the term for which such director was elected or appointed, or until such director’s earlier death, resignation, or removal.

Our amended and restated certificate of incorporation permits the holders of the Class C common stock, voting as a separate class, to elect up to two members to the Board subject to certain limitations set forth therein. In connection with our IPO, we entered into the Stockholders Agreement with investment funds affiliated with our Sponsor governing certain designation rights with respect to our Board following our IPO. Pursuant to the terms of the Stockholders Agreement, investment funds affiliated with our Sponsor have the right to designate up to two of the directors serving on our Board.Board, subject to certain limitations set forth therein. Currently, our Sponsor has the right to designate, and the holders of shares of Class C common stock have the right to elect, one director, pursuant to the Stockholders Agreement and our amended and restated certificate of incorporation. See “Other Matters—Transactions with Related Persons—Stockholders Agreement.”

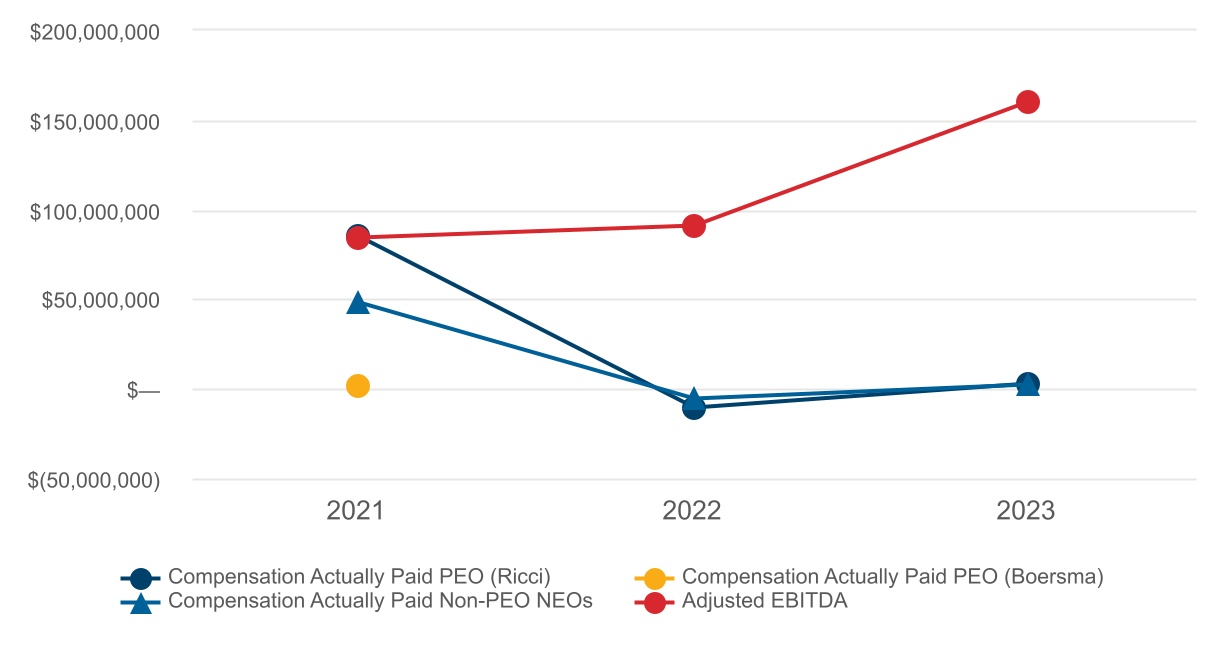

Board Leadership Structure